AIA A-Life Wealth Care provides life protection and savings you need for you & your family

- darrenang

- Nov 28, 2020

- 3 min read

Updated: Nov 29, 2020

Hi there, if life insurance and saving plan are what you are looking for, then the AIA A-Life Wealth Care is just right for you. The plan also comes with different riders that you can choose for different people with different needs. Now let's take a glimpse at the benefits of the plan.

Protecting the future of your loved ones:

Pays 100% of your coverage amount or account value in protection and savings account, whichever is higher, plus the Wealth Account value if you pass away or suffer from total and permanent disability (TPD)*.

Pays 200% of your coverage amount or account value in protection and savings account, whichever is higher, plus the Wealth Account value if you pass away in an accident.

Pays 300% of your coverage amount or account value in protection and savings account, whichever is higher, plus the Wealth Account value if the accident happens while you are in public conveyance (transportation)*.

Pays 600% of your coverage amount or account value in protection and savings account, whichever is higher, plus the Wealth Account value if you pass away due to a natural disaster*.

Note: Only one of the benefits above shall be paid.

Rewards you with a good behaviour with a wealth account:

Every 5 years and up to maturity, we will reward you with 0.33% of your coverage amount which will be placed into your Wealth Account, provided that:

• No withdrawals are made for the preceding 5 years from your account (except for Life-Stage Celebration event withdrawals); and

• Premiums are paid up to date. Life-Stage Celebration: Withdraw up to 100% of your Wealth Account for each event, capped at 5 times.

Life-Stage Celebration:

Withdraw up to 100% of your Wealth Account for each event, capped at 5 times. Each event below is only allowed once, except for “personal milestones”, which is capped at 2 times.

-Graduating for tertiary education

-Getting married

-Having new child

-Child getting married

-Getting new house

-Buying a car

-Starting a company

-Retirement after age 60

-Personal milestone

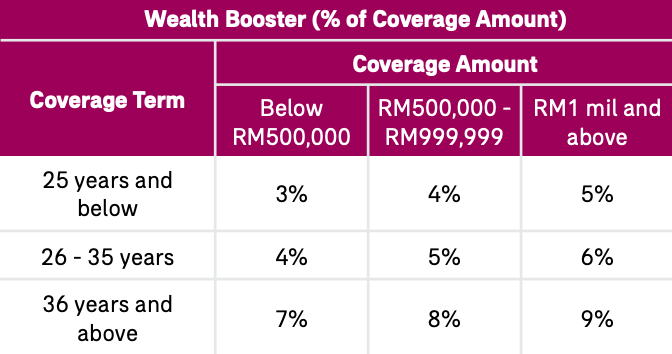

Enjoy wealth booster

• Rewards you for longer and higher coverage! Wealth Booster will be paid out at maturity, and will be calculated based on the policy term and sum assured, as below:

• Opportunity to double your reward! Double your Wealth Booster if you meet the following conditions:

- No withdrawals are made from your account (except with withdrawal for Life-Stage Celebration events); and

- Premiums are paid up to date

Enhance your protection

Enjoy even wider coverage with the following optional benefits:

A-Plus Overseas Cover*

Allows you to reimburse your medical bills, flight tickets and accommodation for up to 50% of your coverage amount or up to RM1,000,000, whichever is lower, for treatment overseas (for any one of the covered critical illnesses). The reimbursement of flight tickets and accommodation is capped at RM20,000 per lifetime.

A-Plus Extra Cover

Provides you with additional coverage if you pass away or suffer from total and permanent disability (TPD* ), with a coverage term of 10, 15 or 20 years.

A-Plus CI Protect

This optional benefit provides you with additional coverage for 39 critical illnesses. You are also entitled to enjoy Personal Medical Case Management (PMCM) service, that focuses on ensuring that you receive advice on the best possible treatments and personalised ongoing support throughout your medical journey when you are facing serious medical conditions.

A-Plus Waiver

Ensure continuous premium payment if you are diagnosed with any one of the 38 covered critical illnesses or undergo a covered surgery.

A-Plus Spouse Waiver Extra

Ensure continuous premium payment if your spouse passes away, suffers from TPD* or is diagnosed with any one of the 38 covered critical illnesses or undergoes a covered surgery.

A-Plus Parent Waiver Extra

Ensure continuous premium payment if the Insured’s parent passes away, suffers from TPD* or is diagnosed with any one of the 38 covered critical illnesses or undergoes a covered surgery

High Non Medical Limit

You can get covered for up to RM4 million without having to go for a medical checkup*.

Get more value through vitality wealth booster

Vitality Wealth Booster is an additional benefit given to you when you sign up as an AIA Vitality member upon the purchase of A-Life Wealth Care. Depending on the healthy choices you make, you may receive additional value* when your policy matures, when your policy terminates due to death, or upon 100% payment of the TPD benefit, without having to pay additional premium.

*Please speak to our life planner for more details.

Here's a good illustration, let's take a look at John's case:

That is it! Hope you enjoy this article. If you have any questions, feel free to drop me a message at 018-299 3435. See you on the next article.

Comments